The Corporate Transparency Act (CTA) now requires businesses in Boise, ID, to provide detailed Beneficial Ownership Information (BOI) to FinCEN, a step aimed at improving transparency and combating financial crimes.

As of today, 11-26-2024, Boise business owners have 36 calendar days (or 27 business days) left to submit their BOI reports to FinCEN—failure to comply could result in daily fines of $500.

Steps to Ensure BOI Compliance

1. Confirm Filing Requirements

Deadline: ASAP

Corporations, LLCs, and similar entities generally need to file unless exempt (e.g., charities, banks, publicly traded companies).

2. Identify Beneficial Owners

Deadline: 12-10-2024

A beneficial owner is anyone who:

-

Owns at least 25% of the company, or

-

Exercises substantial control over its operations.

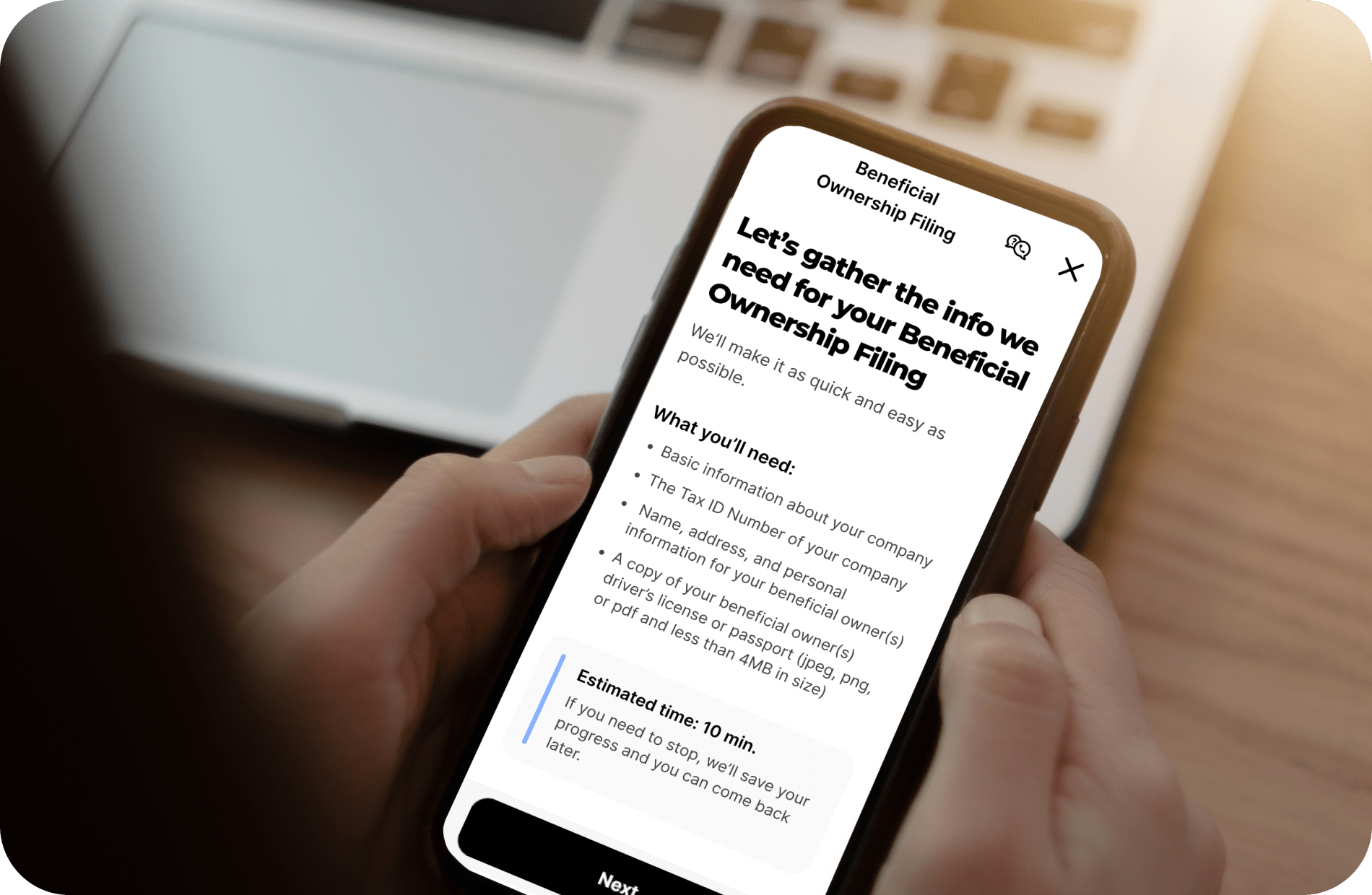

3. Gather Key Information

Deadline: 12-17-2024

You’ll need:

-

Company Information: Legal name, EIN, and address.

-

Owner Details: Full names, residential addresses, dates of birth, and valid ID details.

4. File Your BOI Report

Deadlines:

-

Existing companies: File by 01/01/2025

-

New businesses (2024): File within 90 days of formation

-

New businesses (2025+): File within 30 days of formation

ZenBusiness can help streamline the filing process—see how.

Key Details for Boise Businesses

Who Needs to File?

“Reporting companies” include most small LLCs and corporations. Exemptions cover entities such as nonprofits and banks. For example, a Boise-based boutique consulting firm would likely need to comply.

What Defines a Beneficial Owner?

Beneficial owners are individuals who:

-

Hold 25% or more of company ownership, or

-

Have significant decision-making authority.

Example: A Boise family-owned restaurant where two siblings each hold a 50% stake must report both as beneficial owners.

What Information is Required?

Reports must include:

-

Company Details: Name, EIN, and address.

-

Owner Information: Full names, dates of birth, residential addresses, and government-issued ID numbers.

How and When to File

BOI reports are filed electronically through FinCEN’s online system:

-

Existing businesses: 01/01/2025 deadline

-

2024 startups: 90 days post-registration

-

2025 startups: 30 days post-registration

Penalties for Non-Compliance

Failing to file or submitting false data can result in:

-

$500 daily fines

-

Criminal penalties

Errors can be corrected within a 90-day safe harbor period.

Why Choose ZenBusiness?

ZenBusiness simplifies the BOI filing process with user-friendly tools and expert support. Save time, avoid penalties, and ensure compliance with ZenBusiness’s services.

Additional Resources

Don’t let the January 1, 2025, deadline catch you off guard—start your BOI filing process today!

Help us and our Chamber by completing a quick BOI survey by December 18, 2024! It only takes a few minutes, and for every 25 responses, our Chamber earns a $100 donation. [Click here to take the survey!] We appreciate your time and participation!

*As of December 3, 2024, a Texas federal district court has issued a preliminary injunction for all states to block the CTA and its relevant regulations. However, filing your BOI will help you avoid fines if this injunction is overruled.